How to Financially Prepare Yourself for a Business Failure

"By failing to prepare, you are preparing to fail." - Benjamin Franklin

While most of us see the above quote as inspiration for making sure that our business is ready to succeed, it can also be used when the business fails.

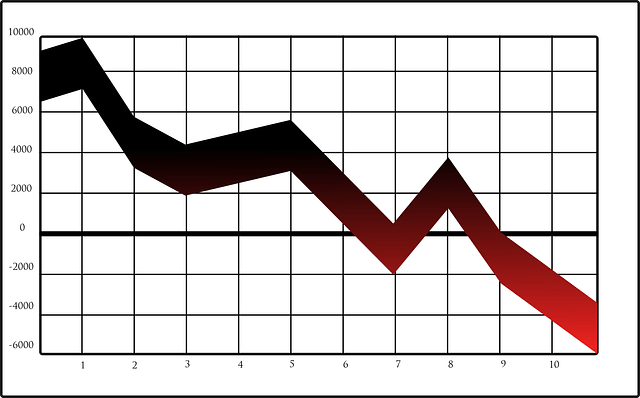

As you’re probably aware, most businesses will fail. That’s just a part of the game. And while you can use that experience to your advantage, you also have to make sure that you are prepared to fail. That may sound like an oxymoron, but it’s true. If you aren’t prepared, you’re heading into a dark territory where you could lose everything and even hurt your chances of starting a new business.

Here are some step-by-step tips for first-time entrepreneurs so that you can prepare for failure before it happens — and save yourself a lot of money and trouble in the end:

Cut Costs and Be Smart With Remaining Money

After seriously assessing the situation and determining that what started as financial trouble might be the sign of the end, it's time to start cutting costs as soon as possible. Open up the books and examine where you can begin to cut down additional costs, whether that’s reducing headcount or eliminating unnecessary expenses.

To be candid, one of the ways that I did this with my own life started with my car. I was driving a brand new BMW X5. This was costing me $600/month + $300/month in gas + $120/month in insurance — a lot of money. So I sold the car and paid cash for an older Ford Focus, reducing my costs to $150/month in gas + $15/month in insurance and saving me $800/month. It's amazing what $800 can do.

Additional ways you can save personal funds:

- Carefully budget discretionary spending

- Pay off credit card debt; start with highest interest/balance first

- Look for deals on eBay, Craigslist, or Amazon before buying at the store

- Ditch extras like cable subscriptions

- Walk and bike to work when possible

While this may not be enough to save the company, it will save you some much-needed money to put aside for the future or for use in settling debts. Remember, if any business debts aren’t cleared, creditors will go after your investors, which means you can forget about asking them for money the next time around. In short, be smart with the money you have left.

Have a Fire Sale

Speaking of settling any debts, you may want to consider having a fire sale. Offer products or services at a discounted rate. Sell off any assets, such as office furniture or equipment. Making any sort of money is better than just walking away. It may not be enough to pay off every debt, but it’s a start.

Seek Counsel Regarding Personal Liability

Find out if you are personally liable for the debts of the business. If so, creditors could come after your personal assets. Everything from a personal bank account to your house could be used to settle any debts. Once you’ve identified which debts you are liable for, find out what you can do to prevent losing any of your savings or home. Before seeking legal counsel, review this article from NOLO. It will give you a better understanding of which debts you are personally liable for.

Inform Those Who Need to Know

It’s not going to be easy to tell investors, board members and shareholders — or, for that matter, your employees or family — that the business is failing. It is, however, the best course of action. When consulting with these important individuals, they may give you suggestions on what the next move should be. They may even have relevant experience and be able to guide you in the process of shutting the business down.

By being responsible, you’re also preserving the chance to work with these people again when you launch your next business.

Before, During, and After Failure: Save for a Rainy Day

While your startup is in its early stages, you should always be cutting personal costs to a minimum. Do you need to go out to dinner every night? Do you need cable? Should you take that vacation to Hawaii? Do whatever you can to cut costs so that you can save that money for an emergency. (If you can't do this, starting a business may not be the right decision for you in the first place.)

Here’s a cool piece from LifeHacker that shows where people spend most of their money. Read it, and save accordingly.

One way that my wife and I have worked out to prepare for the worst is what I call “John Rampton's 20 percent rule.” Twenty percent of everything I make goes into my wife's bank account. I can't touch it, no matter what. We've learned to live our life well below our means and to be creative with our personal investments. She gets her 20 percent and invests in low-risk assets (like paying cash for a house and renting it out), and I can't touch the money she earns from that. It's not mine; it's for our family.

This rule has helped us survive the several times that my different companies have failed. (Even when I came begging for money, she wouldn't give it to me.)

I recommend that every entrepreneur out there have some sort of a plan for the small chance that they might fail. If you don't have a spouse, learn to save 20 percent of what you make each month and put in an account that you can’t touch until a certain date. This way, if your business goes under or an emergency happens, you’ll have some money to fall back on. Note: This money isn’t backup money to put in your business. That should be kept somewhere else. This is money that you keep aside to live on, for you and your family.

What other advice would you offer a first-time entrepreneur facing possible failure?